The best Side of Fredericksburg bankruptcy attorney

Your debt is frozen. All debt on unsecured statements are frozen the day you file for Chapter thirteen. This implies payments you make to the creditors are accustomed to pay out down financial debt rather than becoming eaten up by desire and late service fees.

It’s feasible to file for Chapter 13 bankruptcy defense “pro se”: with no assist of the attorney. Nevertheless, Chapter thirteen is advanced. It’s simple for an inexperienced Professional se filer to help make a error That may bring about the bankruptcy court docket refusing the petition.

Action 1 – Gather Paperwork – Gather your monetary documents so that you and your attorney can evaluate your debts and your Total fiscal wellness and focus on no matter if a bankruptcy filing is acceptable. This can be the first step in the method.

Bankruptcy nevertheless could possibly be an choice for you, nevertheless, if erasing other forms of credit card debt — charge cards, personalized financial loans, professional medical expenditures — would unlock more than enough income to pay the debts that may’t be erased.

The two initial consultations need to be free of charge. These conferences will assist you understand your instances and judge no matter whether bankruptcy is the best route to Obtain your finances again on target.

Consolidating may additionally help you save you revenue on interest in the event you’ve improved your credit rating score considering the fact that using out your original financial loans. Also, debt consolidation farifax bankruptcy attorney financial loans usually come with decrease rates than charge cards.

Finest IRA accountsBest online brokers for tradingBest on the web brokers for beginnersBest robo-advisorsBest options investing brokers and platformsBest investing platforms for working day trading

Bankruptcy may help you using a have a peek here contemporary start should you’re away from solutions, nevertheless it’s not an right away final decision. Learning how you can file read review for Chapter 13 bankruptcy can assist you choose if this measure is right for you.

You can hold your business read review up and managing. If you are a sole proprietor, Chapter thirteen allows you to continue to carry out organization. It is necessary to remember that your enterprise will have to produce ample profits to help you make regular monthly Chapter thirteen payments.

This chapter of the Bankruptcy Code delivers for adjustment of debts of an individual with standard income. Chapter 13 makes it possible for a debtor to maintain home and pay out debts after some time, generally 3 to 5 years.

Secured debt. Financial debt assured by collateral, such as your property or car or truck, is "secured" personal debt. You must spend secured financial debt payments and arrearages to help keep the house.

Get your no cost credit rating scoreYour credit reportUnderstanding your credit history scoreUsing your creditImproving your creditProtecting your credit score

You’ll get court approval of a decide to repay both of those unsecured and secured debts partially or in complete. You may pay back over three to five more years and will retain your property. At the tip, the remainder of some debts can be forgiven.

When you understand how Chapter thirteen normally operates, You will likely want a lot more particular information. You'll find further assets to suit your needs at the conclusion of the short article.

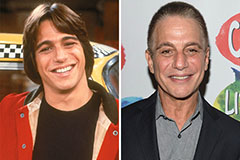

Tony Danza Then & Now!

Tony Danza Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!